Fear and Greed Index

Fear and Greed Index is one of the most popular financial indicators. It can measure the sentiment and emotional state of investors in the Financial Markets.

It was first introduced as a tool at the Stock Financial Market by calculating price momentum and market volatility. By taking an equal weighted average of several indicators, it is a useful tool for Forex and Cryptocurrency markets.

It is designed to capture the level of fear or greed prevailing in the Market at any given time. The index attempts to quantify the emotions and sentiments that drive investors’ behavior. As such, these emotions can have significant impact on market movements.

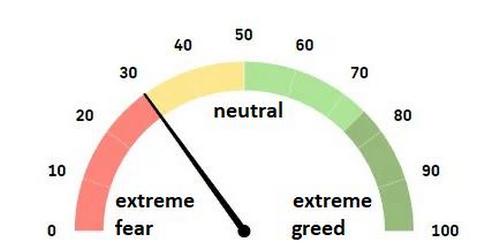

The index ranges from 0 to 100. Extreme fear represent lower index’s values and extreme greed higher values. An Index reading of 0 indicates maximum fear, suggesting that investors are extremely pessimistic. At these Market conditions, they may be selling aggressively. On the other hand, a reading of 100 suggests extreme greed. This is an indication that investors are optimistic about the Market, and they increase their exposure. A 50-level indication is a neutral market sentiment.

One of the biggest advantages of Fear and Greed Index is its simplicity. Many traders can divide the 0-100 zone into quadrants (0-25 level, 25-50 level, 50-75 level, 75-100 level). Then, to apply specific trading plans and strategies for each quarter of the Index.

It is also useful as a Risk Management tool. Investors can increase their cash allocation when Markets are trending downwards. On the contrary, they can increase their exposure when the Markets are trending upwards. During a bear market, prices fall, and fear prevails. Following an investment strategy, according to the Index, an investor should increase its cash allocation to protect his/her portfolio. Once there are signs that the Market starts to recover, the strategy will switch from cash to buying power. Hence, it can take advantage of the rising prices an investor’s exposure will be increased. When the Index reaches extreme levels, it may indicate that a potential reversal in Market sentiment is possible. Therefore the price direction has an increased possibility and it may change.

Taking into consideration the above, the Index can be used for timing Market entries and exits situations. By checking the Index level, a trader may spot possible market trend reversals. Hence, to find trading opportunities to enter the Market.

Fear and Greed Index is just one tool among many used by investors and traders to analyze the Market(s). It should be used together with other technical and fundamental Market analysis techniques. All together, they show a path to make investment decisions and not as standalone process.