Money Management and Risk Management in forex trading

Money management and risk management are two important aspects for forex trading which aim to protect and optimize the capital investment portfolio in trading activities.

Although many traders may think that Money Management is an easy and understandable concept, which is a way of managing your money and investing wisely, in reality is not that simple.

Upon entering a forex trade, traders need to have a solid understanding of the risk situations involved. Money management refers to strategies and techniques used to manage funds and allocate risk accordingly. The primary goal of money management is to preserve capital, minimize losses and maximize profits.

Below, we will analyze the most common key elements of money and risk management in forex.

Position Sizing

This involves determining the appropriate amount of capital to allocate to each trade. Traders typically use a percentage of their available trading capital or a fixed dollar amount as a position size.

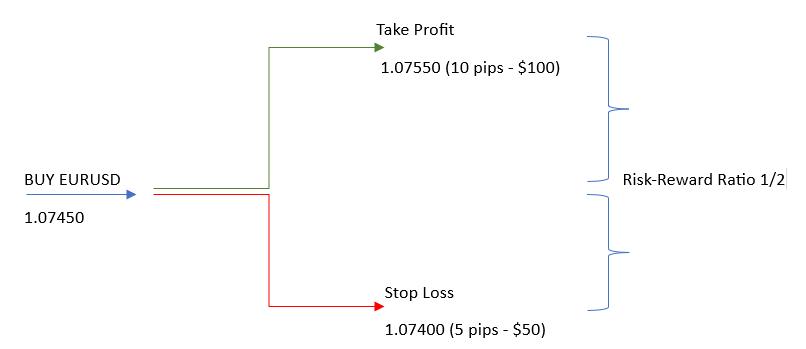

Risk-Reward Ratio

It is crucial to assess the potential reward compared to the risk of a trade. Traders often aim for a favorable risk-reward ratio when potential profits outweigh potential losses. A common practice for scalping and short-term trading is a 1-to-2 or 1-to-3 risk-reward ratio. For example, a trader is placing a trade with limits either to lose 1 pip (or 10$) or win 2 pips (or 20$). Using this technique, traders can also determine their risk tolerance in regards of their trading. We will analyze a full trading example at the end of this article, taking into consideration more Money and Risk Management parameters.

Stop Loss Orders

A stop loss order is a pre-set order which automatically closes a trade when a certain predefined price level is reached. With this way, traders can limit their potential losses in case the market moves against them.

Take Profit Orders

A take profit order is an order that automatically closes a trade when the price reaches a predetermined level. These types of orders allow traders to secure their profits by exiting at a favorable price.

Diversification

Diversifying trades across different currency pairs, stocks, and other asset classes can help traders to spread the risk and reduce the impact of potential losses.

Risk Assessment

Traders need to evaluate any potential risk involved in each trade, considering market conditions and volatility, economic events and geopolitical factors. This assessment helps in making informed decisions and adjustments in trading strategies accordingly.

Risk Monitoring

Continuous monitoring of open trades, market conditions, and news events is important to identify and manage any potential risks promptly. Regular evaluation and adjustments of trading strategies based on market conditions are essential for an effective risk management.

Taking all the above guidelines into consideration, let’s see a trading example, where we apply certain settings as per a specific and pre-defined money and risk management.

In case a trader has an available trading balance of $1000 and decides to risk 5% of the balance ($50) in every trade. In case the client trades in a standard lot (1 lot -> 100,000 units), then every pip costs $10. The trader is willing to lose these $50 as per his risk plan, hence a Stop Loss order can be placed 5 pips away from the opening price (5 pips X $10 = $50).

On the other hand, if the trader follows a 1-to-2 Risk-Reward Ratio, he/she can place a Take Profit limit order at 10 pips away from opening price. This way, he/she will be willing to close the trade when the price moves on his/her favor for 10 pips, that will be double the amount is USD for his winnings (10 pips X $10 = $100) against his/her potential losses ($50). Risk-Reward Ratio will be 1-to-2, that is 5-to-10 pips or 50-to-100 USD.

For more information and to get acquainted with regards to pips, pips’ value, and pips calculations, you can check our artice: What is a pip – pip’s value and pip calculations.

By combining money management and risk management techniques, forex traders can enhance their chances of long-term and successful trading, while effectively protecting their capital. Finding and testing different trading strategies and plans, either high risk or low risk, it is always important to note that once you try to invest in a real forex trading account, you should never invest what you cannot afford to lose.